GSTIN Structure & codes

What Is GSTIN?

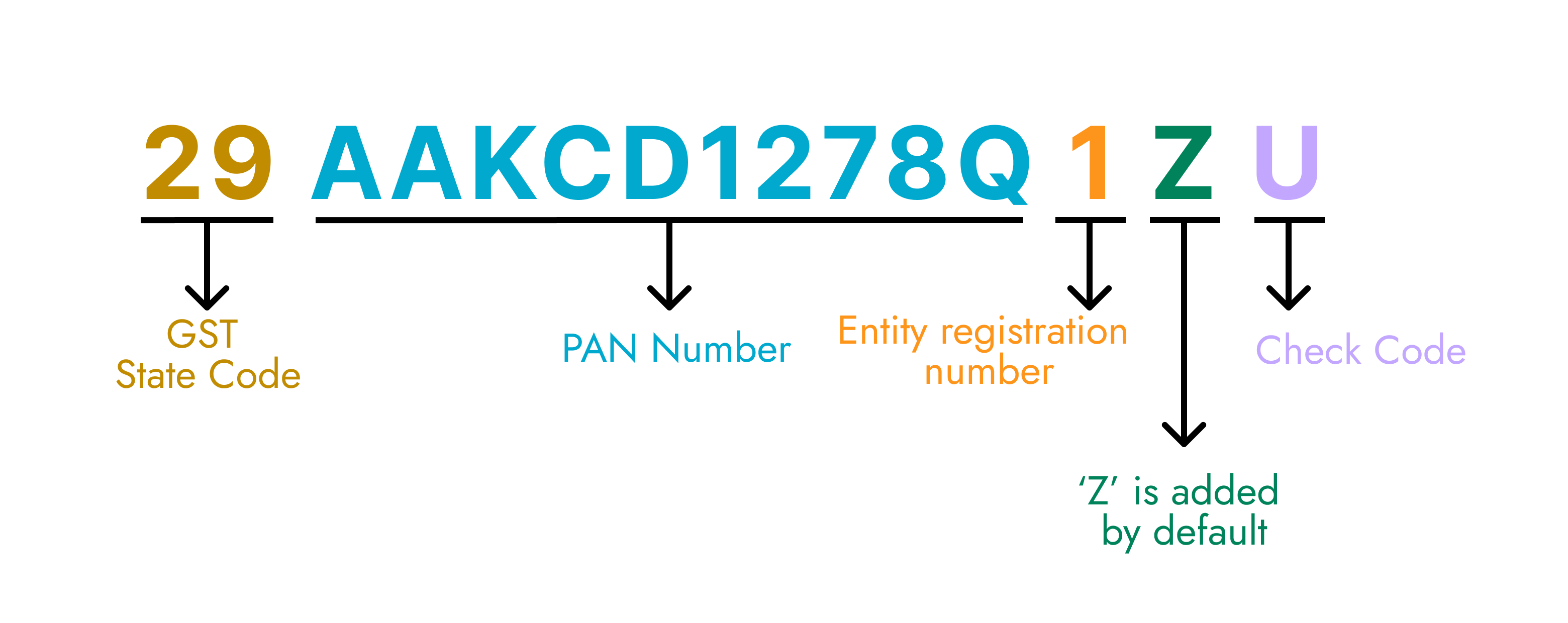

GSTIN, or Goods and Services Tax Identification Number, refers to a 15-digit unique alphanumeric code that is assigned to a business for tax purposes. GSTIN replaced the Tax Identification Number[TIN] that was previously allotted to businesses under the VAT system.

GST state code and GST jurisdiction are important datapoints for businesses to ensure a hassle-free processing of GST returns, applications, and assessments, and to avail facilities under the law.

1st-2nd: State code; each state has its own custom code. For example, Uttar Pradesh has 09 and Karnataka has 29.

3rd-12th: Digits 3-12 represent the PAN of the entity. It denotes the connection between the GST and the PAN database.

13th: 13th digit is alpha-numeric (1-9 and then A-Z) and is assigned based on the number of registrations a legal entity (having the same PAN) has within one State. For example, a legal entity with single registration within a State would have number 1 as 13th digit of the GSTIN. If the same legal entity goes for a second registration for a second business vertical in the same State, the 13th digit of GSTIN assigned to this second entity would be 2. Hence, a legal entity can register upto 35 business verticals within a State.

14th & 15th: Of the last two digits of the GSTIN, the first digit is kept blank for future use(‘Z’ is being used by default & added in all GSTIN issued till date) and the last digit is used as a check digit.