A primer on Treasury

Treasury management is an essential function for any business, irrespective of its size. It involves managing the enterprise's holdings, with the ultimate goal of managing the firm's liquidity and mitigating operational, financial, and reputational risk. This includes handling receivables and payables, managing cash, and planning for future growth or challenges.

The primary objective of treasury management is to optimise a company's liquidity, making sound financial investments, and efficiently managing the company's financial risks. Treasury management's role is critical in both planning the organisation's financial strategy and supporting its operational needs.

Key Areas of Treasury Management

-

Cash Management:

Cash management involves managing the cash flows in and out of the business. This includes payment processing, maintaining optimal cash levels, and managing bank relationships. -

Liquidity Management:

Liquidity management is about ensuring the business has sufficient cash to meet its obligations while minimising idle cash. This

involves short-term investing and borrowing, managing working capital, and implementing cash forecasts. -

Risk Management:

The Treasury is responsible for identifying and managing financial risks, including currency, interest rate, and credit risks. This

involves implementing hedging strategies and managing insurance coverage.

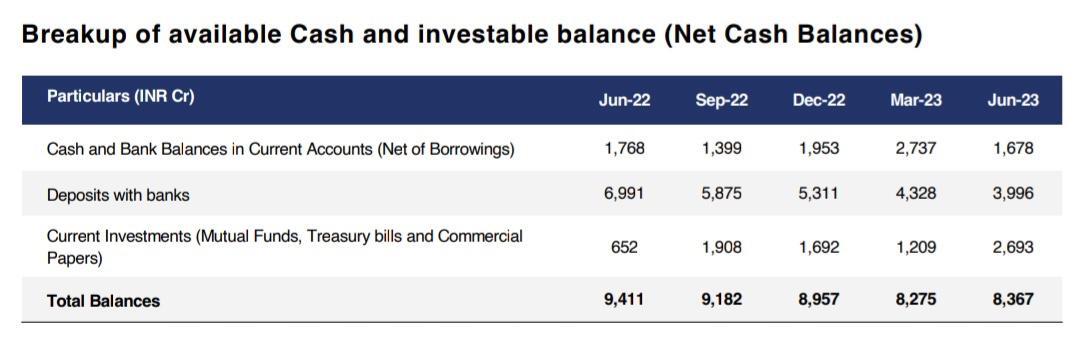

Handling Excess Cash and Investments

One of the most important aspects of treasury management is how to handle excess cash. Leaving money idle in a bank account may be the easiest option, but it's not the most effective way to grow your assets. Here are some investment options to consider:

Best businesses are excellent capital allocators, they make every cent working for each second. Braeburn Capital which is an arm of Apple to manage the company’s giant cash pile by investing in different asset classes.

-

Bank Deposits

One of the simplest ways to invest excess cash is by putting it in a bank deposit, such as a Fixed Deposit or a high-yield savings

account. Although the returns are relatively low, they are highly secure. -

Money Market Funds

Money market funds are low-risk mutual funds that invest in high-quality, short-term debt from governments, banks, or corporations. They offer higher returns than bank deposits and are highly liquid.

-

Treasury Bills

Treasury bills (T-bills) are short-term securities issued by the government. They are considered the safest investment because

they are backed by the full faith and credit of the government. -

Bonds

Bonds are debt securities issued by governments and corporations. They have higher potential returns than money market funds,

T-bills, or commercial paper, but they also have higher risk and lower liquidity. -

Equity Investments

Investing in the stock market can yield high returns, but it also comes with significant risk. It's important to have a good

understanding of the stock market before investing in it.

Conclusion

Treasury management is a complex but essential function for startups and SMBs. While it involves many responsibilities, one of the most critical is handling and investing excess cash. By understanding the different investment options available and how they align with your company's risk tolerance and financial goals, you can make the most of your company's assets and support your company's runway.